Expand Your CMS Capabilities with Our Plugin Store

Cs-Cart, Drupal, Magento, OpenCart, PrestaShop, WordPress, ZenCart

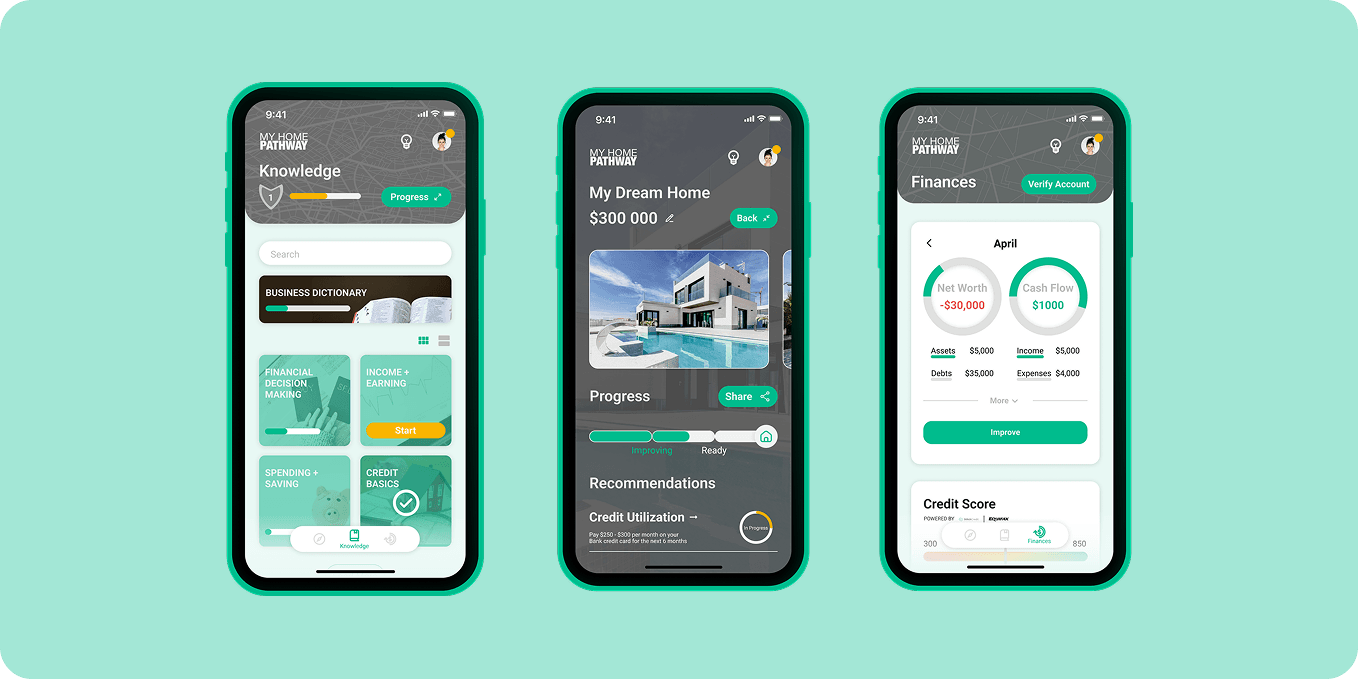

My Home Pathway

Web development

Mobile applications,

Big data and analytics

Industry:

Financial Services, Real Estate

About Client:

Kasley Johnson founded My Home Pathway in 2020 with a mission to transform homeownership accessibility in the U.S. The mortgage approval process has long been outdated, opaque, and challenging, particularly for first-time buyers with limited credit history or student loan debt. My Home Pathway aims to bridge this gap by offering financial assistance for first-time buyers and empowering users with the knowledge and tools needed to improve their financial standing.

With over 15 years of experience in the financial sector, Kasley has worked with some of the world's leading institutions, including Goldman Sachs, Ernst & Young, AIG, Bank of Montreal, and the Federal Reserve Bank of New York. Having seen the system from both private and regulatory perspectives, he recognized that homeownership readiness in the U.S. often comes down to a three-digit number – a credit score. However, understanding and improving creditworthiness remains a complex challenge for many.

Kasley’s vision is clear: every aspiring homeowner should have access to the right financial guidance, assistance with buying a home, and resources to navigate the mortgage process—regardless of their credit score, student loan debt, or income level. With this goal in mind, he launched My Home Pathway, a platform designed to simplify mortgage approvals and help individuals take their first steps toward homeownership financial education and first-time buyer assistance.

About Project:

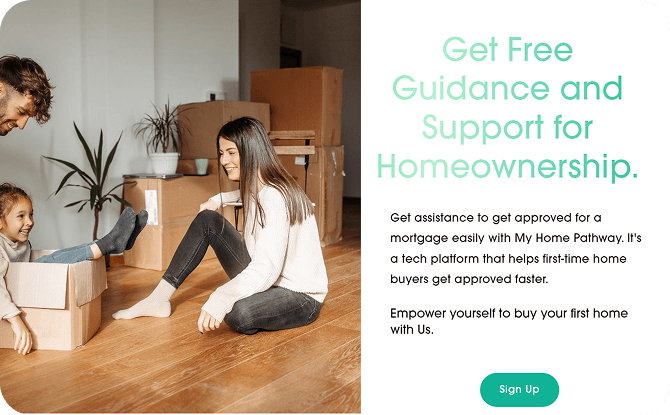

My Home Pathway is an innovative platform designed to help new homeowners navigate the complex mortgage approval process with ease. The platform provides financial assistance for first-time buyers, offering step-by-step guidance to improve credit readiness, understand homeownership costs, and access tailored mortgage solutions.

Traditional home financing can be overwhelming, especially for those with limited credit history or student loan debt. Many prospective homebuyers struggle with understanding mortgage requirements, pre-approval steps, and financial planning for homeownership. My Home Pathway simplifies this process by offering a personalized roadmap to buying a home, educating users on improving their credit scores, increasing mortgage eligibility, and preparing for long-term financial stability.

The platform also provides expert guidance on assistance with purchasing a home, helping users navigate pre-approval, loan options, and down payment requirements. Through real-time credit monitoring tools, users can track their financial progress and make informed decisions that bring them closer to homeownership. Additionally, My Home Pathway connects buyers with available mortgage support programs, ensuring they maximize opportunities for assistance and reduce financial barriers.

By delivering clear financial insights and mortgage readiness assessments, My Home Pathway empowers individuals to take control of their homeownership journey. With the right tools, resources, and expert-backed strategies, users can confidently work toward achieving their dream of owning a home.

Goals and Objectives:

1

Increase homeownership accessibility by helping first-time buyers overcome financial barriers, including limited credit history, student loan debt, and low mortgage eligibility

2

Streamline the mortgage approval process through an intuitive digital platform that offers financial assistance for new homeowners and guides them step by step

3

Enhance financial education by providing tools that improve credit readiness, increase mortgage eligibility, and help users make informed financial decisions

4

Offer expert-backed assistance with buying a home, ensuring users understand mortgage pre-approval steps, loan options, and down payment requirements

5

Integrate credit monitoring tools that enable users to track their financial progress and improve their mortgage readiness over time

6

Connect users with first-time buyer assistance programs and affordable home loans, allowing them to access financial support and reduce the upfront costs of homeownership

7

Ensure a secure and transparent mortgage process that builds trust and confidence in users’ homeownership journey

8

Empower individuals to take control of their financial future and move one step closer to becoming new homeowners

Solution:

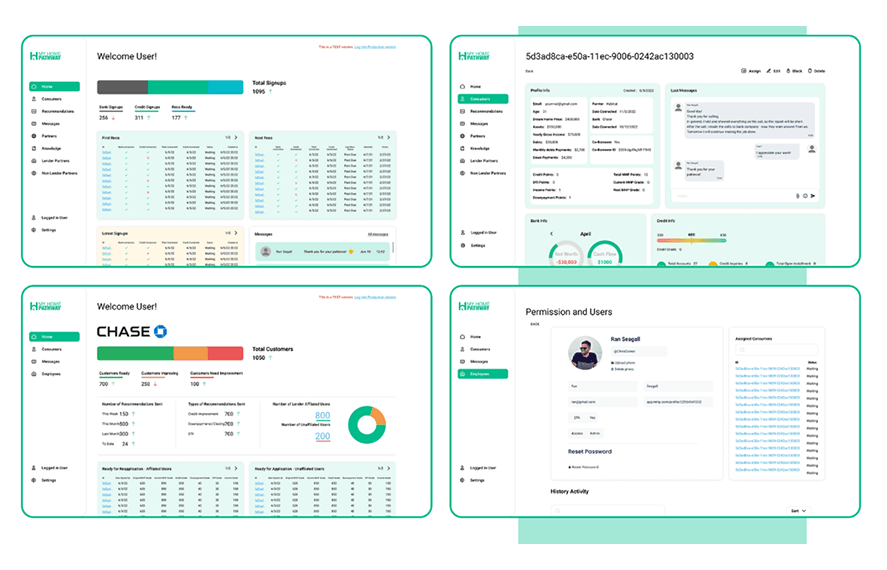

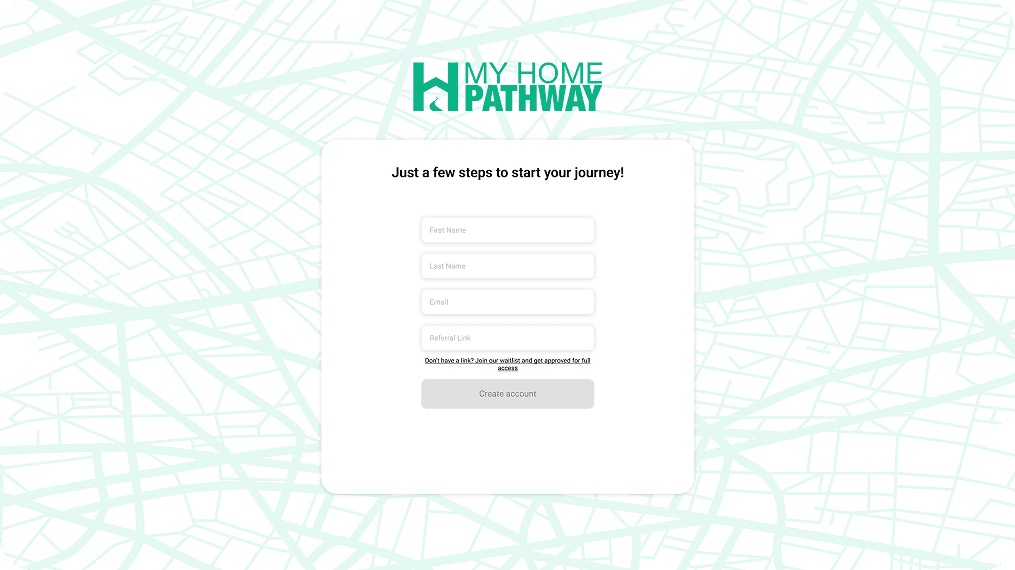

To create a seamless digital experience for first-time buyers, My Home Pathway required a comprehensive approach to platform development. The project began with the design and implementation of a user-friendly landing page, built using ReactJS and Chakra UI. This ensured an intuitive interface, making it easier for users to explore homeownership assistance options and understand the mortgage approval process.

To further enhance accessibility, a mobile application was developed using React Native, providing a smooth and responsive experience across both iOS and Android devices. The app integrates key features such as financial education resources, credit tracking tools, and mortgage readiness assessments, allowing users to actively monitor their progress toward securing a home loan. The backend system was built using Node.js, Express, and PostgreSQL, ensuring secure data storage and efficient processing of mortgage applications. Additionally, a CRM system was developed using ReactJS and Chakra UI, enabling My Home Pathway to effectively manage user interactions, financial data, and mortgage pre-approvals.

To strengthen user confidence, credit monitoring and financial tracking solutions were integrated, helping individuals understand their financial standing and improve their mortgage eligibility. The platform was rigorously tested for performance, security, and compliance with financial regulations to ensure a reliable and trusted experience for users.

Following successful deployment, My Home Pathway continues to evolve with regular updates and feature enhancements. By offering a secure, data-driven, and user-centric solution, the platform enables aspiring homeowners to overcome financial challenges and take meaningful steps toward purchasing a home.

Tools & Technologies:

Total time:

2 months

Result

The implementation of My Home Pathway has significantly improved the homeownership journey for first-time buyers, providing them with the tools and resources necessary to navigate the mortgage approval process. By offering financial assistance and expert-backed guidance, the platform has helped users increase their mortgage eligibility, strengthen their credit profiles, and gain a deeper understanding of the financial aspects of homeownership.

One of the most notable achievements of the platform is its impact on financial education. Through personalized insights and real-time financial tracking, users have developed a better grasp of their financial situation, enabling them to take informed steps toward homeownership readiness. As a result, more users are now successfully obtaining mortgage pre-approvals and overcoming common financial obstacles that previously stood in their way.

The mobile application has further enhanced accessibility, allowing users to stay informed, receive tailored mortgage recommendations, and track their financial progress from anywhere. The integration of credit score improvement tools has empowered users to make strategic financial decisions, leading to a higher rate of mortgage approvals and long-term financial stability.

Additionally, the CRM system has optimized the management of user interactions, ensuring that every individual receives personalized support and timely assistance. By prioritizing transparency, security, and user engagement, My Home Pathway has built a platform that fosters trust and long-term user satisfaction.

By continuously enhancing its features and expanding financial education resources, My Home Pathway remains a leading solution for those seeking to take their first steps toward homeownership. The platform’s success is reflected in its growing user base, positive feedback, and increasing role in helping individuals achieve financial independence and secure a home.